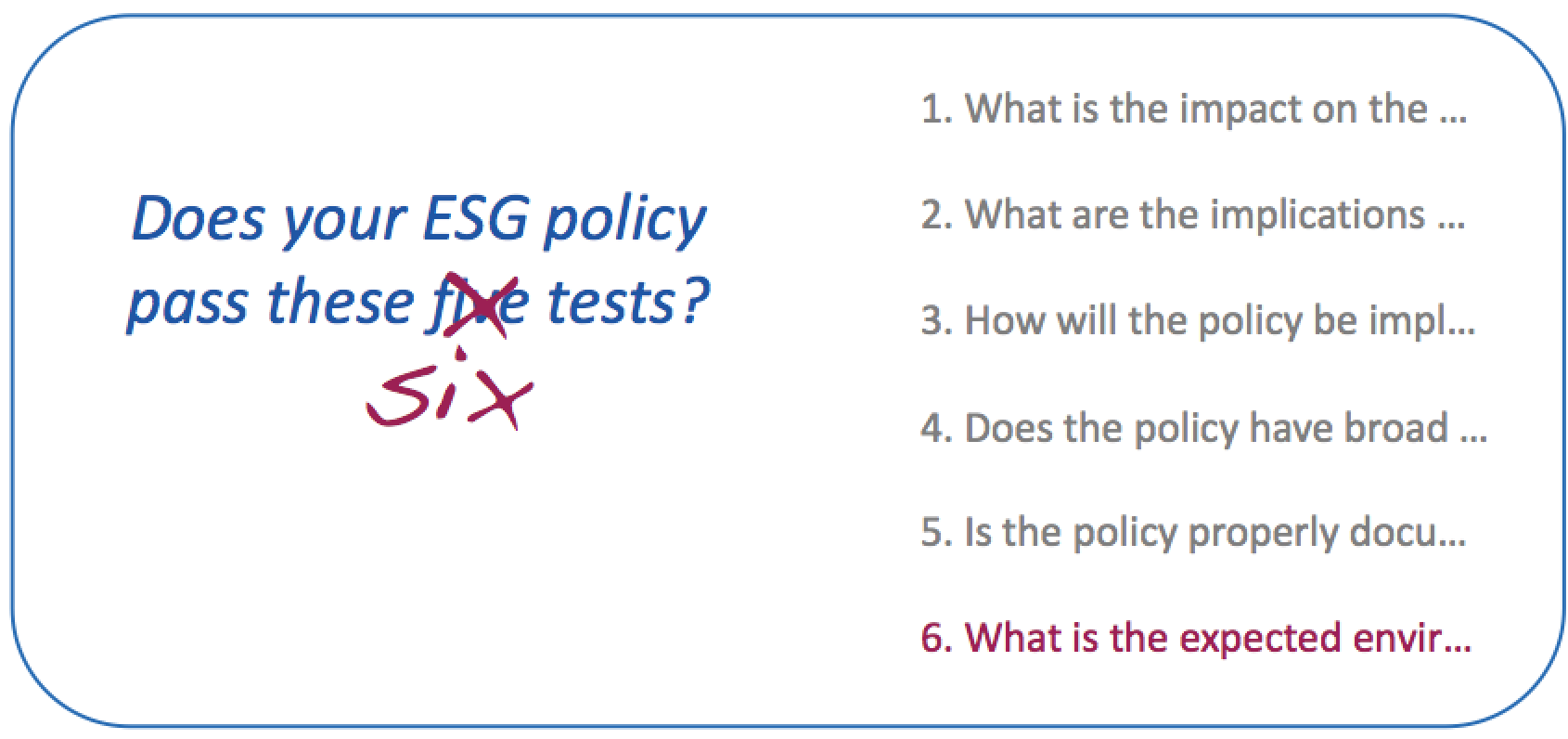

“Hold on a moment”, you may be thinking. “Didn’t you just write a post about the five tests of an ESG policy? Haven’t these tests been around for more than twenty years?”

Well, yes, and yes: I did and they have. But sometimes we need to revisit things. And it turns out there are not just five tests, but six.

Let me clarify. The five tests are five questions that the trustees of pension funds, and other institutional investors, should ask themselves as they develop their ESG investing policy. These questions are:

1. What is the impact on the expected level of investment return?

2. What are the implications of the policy with regard to risk?

3. How will the policy be implemented?

4. Does the policy have broad stakeholder acceptance?

5. Is the policy properly documented?

For a fuller discussion of those questions, here’s a link to the earlier post I mentioned above.

So what did I miss? This:

What is the expected environmental and/or social impact of the policy?

Because while the impact of the ESG factors on the investment program is essential for trustees to understand, impact flows the other way too.

Just about all business activity has spillover effects on the environment, on communities, on society. An ESG policy should acknowledge these wider implications of the investment process. This remains true even if the policy is to base all investment decisions on financial implications only. Because even if the broader impact is not a factor in investment decisions, that impact is still real. And there’s a growing expectation that it should be brought out into the open.

ESG, done right, can be a synthesis of financial best practice and conscious alignment with a more sustainable economic model. That’s only possible if we pay attention to the wider context in which we are working. Hence the addition to the list.

As it happens, the very first draft of the original 1999 paper – thrown together one weekend in response to a UK regulatory development – had just three tests. But as I worked with John Ilkiw and Mike Clark to develop the final paper, three quickly became five. And even those five have evolved over the years: the original formulation considered only the views of members, but a client conversation led to that being broadened to stakeholders (most importantly, the plan sponsor, but potentially others also). So, things change. It’s time to move on again. From now on, I’ll no longer be talking about the five tests of an ESG policy, but six.